Market intelligence: interest rate rises

Families and businesses across the UK are feeling the squeeze as interest rates continue to rise through the year. The property sector is also feeling the effects of interest rate increases, with consequences for investors, developers and homebuyers, as Ballymore’s Head of Underwriting David Morris explains.

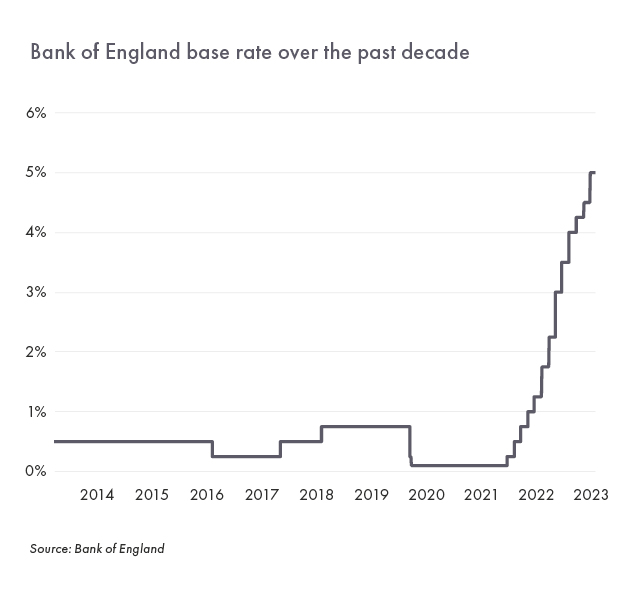

When the Bank of England’s Monetary Policy Committee voted to raise the base rate last month, it was the UK’s 14th consecutive interest rate rise. It’s difficult to predict where we’ll go from here; higher interest rates increase the cost of borrowing, whether you’re a homebuyer wanting a mortgage or a developer looking to finance a development. That is presenting a more challenging environment at every stage of delivering a development, from financing site acquisitions through to selling new homes.

The rising cost of development finance

Like the cost of borrowing for mortgages, the cost of development finance has escalated dramatically – more than doubling over the past year. As a result, the price at which developers need to sell homes increases to compensate for this.

This cost increase has to be seen in the wider development context where new regulations are placing greater demands on developers in areas like design and sustainability. The sector is getting to grips with complexities like the new building safety requirements, including the need for a second staircase in higher rise buildings, which increases build costs and reduces sale-able space.

Objectives like these are positive and often essential, but they ultimately increase the price at which we need to sell a home to compensate for the additional costs. Where the price required is above what we believe is achievable the project becomes unviable.

Tougher investment markets

At the same time, the increase in interest rates is increasing what is referred to as ‘the risk-free rate’, which is the return achieved from government bonds or money in a bank account. If an investor can receive 4.5% or 5% return on a government bond, then they will need to see higher reward for taking additional risk, such as owning real estate. The yield (income of a building divided by purchase price) being demanded by investors increases to compensate for this. Whilst investors were willing to accept 3.5% to 4% yield on real estate 18 months ago, as the ‘risk free rate’ than was almost zero, now investors are demanding yields in excess of 5%. If the income has remained constant, which will be the case for most offices over the past 18 months, then the yield movement results in a c. 25% decrease in value.

Another factor causing lenders concern, is the ability of investors in the office sector to service their loan facilities. Lenders are doing that by focusing on what’s called the interest coverage ratio (ICR) – which is a metric that measures the difference between the income of the building and the interest on any loan. As interest rates increase and income remains static this metric can cause office owners to default on their loans.

There have been concerns for some time about post-pandemic office occupancy rates, which, although rising, are still down on pre-pandemic levels. But alongside that, a number of major business names have made environmental, social and governance (ESG) commitments about their plans for their office space, and will want to be in the very best buildings.

This creates a domino effect for older less energy efficient buildings. Their ability to let the building has reduced dramatically so rents are falling, reducing income at the same time as interest rates are rising, increasing costs and yields are widening, decreasing value. It is in some ways a ‘perfect storm’.

Residential has been less impacted than the office market due to the high demand and lack of supply of quality stock. London did not see significant price increases during COVID 19 compared to other parts of the UK. Construction starts remaining at decade low levels in London, and likely to fall further, mean supply is unlikely to put pressure on house prices.

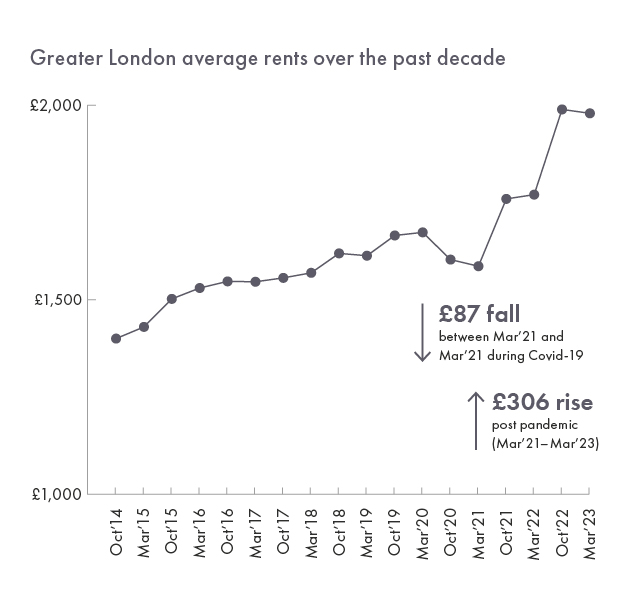

Although there was a trend for people to move out of London through the pandemic, there has been a return since and residential rental prices are increasing dramatically. The residential letting market reacts in a much more rapid fashion than commercial letting markets or the residential sale market to external stimuli and we have seen dramatic growth in rents, which generally rise in line with inflation, making the sector an attractive proposition for a pension fund or investor. This is why Build to Rent is likely to become a larger part of Ballymore’s business going forward.

One dynamic that should be remembered is we are now in an ‘inflationary environment’ and being able to purchase apartments in Ballymore developments two or three years off plan allows investors to benefit from that inflation, locking in a price today, for something you won’t complete on for up to three years, could be very beneficial. That’s important because Ballymore doesn’t just develop buildings; we create places - homes and communities. Prices can rise as completion nears, when the quality of what we’ve created is evident and we’re seeing an investor appetite for quality so we’re in a strong position.